Business Intelligence in Banking Sector

Executive Summary

Spot Billing Hand Held Machines for the Banking sector

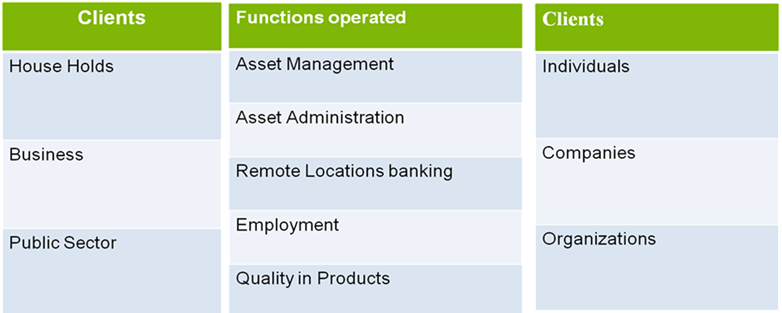

Business Summary: Discovery Analytics, Inc. established in Wilmington, DE in 2015 deals with “Spot Billing” that helps in providing more efficient, more reliable, more secure and more productive for the future innovation of the human kind.

Problem Statement: Most major banks are concentrating on the urban clients and missing out the clients who are setup in the rural areas. The main focus will be on clients/customers who are senior citizens and residing in the rural

areas. Hand held computer which can handle the banking operations would cater the requirements for this project.

Business Solution: Discovery Analytics, has developed a state of the art Windows based rugged Hand Held Computer, Secured payment to meet the end to end field requirement of end customer and Field data Analysis. The Secured payment works as a conventional DOS based CMRI with CBIP compliance and also works as latest Windows based CMRI with DLMS Software tools to read any banking product tool.

Target Market: The target market are people that are going to use the product and cut down their time consumption charges and the banks that can make more reliable and interrupted service.

Sales/Marketing Strategy: The marketing strategy is being done with advanced features giving to the banks like 5 years warranty, free in stallions, software updates, open source technologies.

Business Model: Banking is one of the most important sector of any countries economy. The banking sector consists of broad range of customers, including, rural and urban. By implementing smart metering, that is taking the banking to the household consumers especially the senior citizens in the rural population will not only increase the customer base, but also high savings plans which is win-win for both the banks and the costumers.

Pricing Model: The Pricing model will be a initial one time investment about $120 per machine with the operating

Competitors: Ananth Labs corp,

Competitive Advantage: The Spot billing machines are the first machines to launch in the market. This consist of various operating systems with advanced biometric options for the security of users.

Customer Savings: The following are the advantages of implementing the smart metering. Attract the costumers in the rural areas, increase in the customer base, increase in the savings accounts, exploring the options in the rural markets, research and implementing new products.

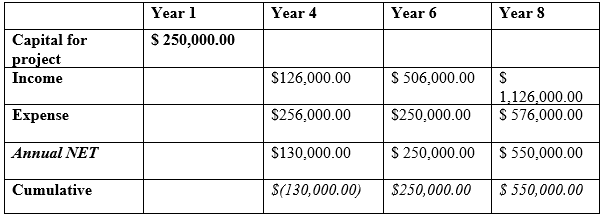

Company ROI ( Return On Investment):f Customers

Capital funding of the project: $250,000.00 for start of the year. Full pay back at year 6 assumes over year doubling of subscriptions by year 8 we can reach double the profits.

KPI’s:

- Number of customers who wish to use the power for half price.

- Supply mode determination

- Going ahead of competitors by taking adaptive strategy.

Business Services

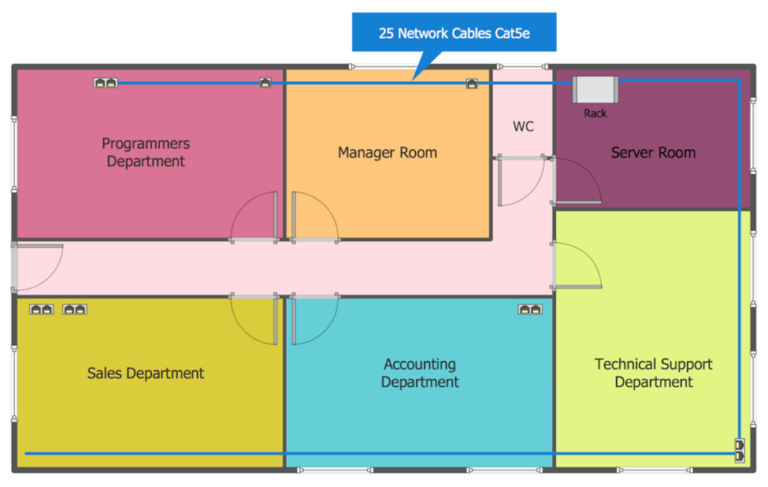

Discovery analytics Inc. will offer small business hand held computer support that will include the following services:

• On site network installation and maintenance

• On site mobile workstation support

• Remote monitoring and servicing

• Custom software applications

• Database management

• software design and hosting

Residential Services:

Discovery analytics Inc. will offer residential customers financial support that will include the following services

• In home mobile servicing

• In home network installation and maintenance

• At home services

• Personal instructor

Retail Services:

• New computer hardware, software, and electronic sales

• Custom built hand held machines

• Multilayer protection and financial security

• Concession for larger companies

Marketing Strategy:

There will be multiple venues that Discovery analytics Inc. will implement in its marketing strategy to promote and increase exposure to the target markets.

• Discovery analytics Inc. will have a vendor booth set up at local community events throughout the year. Raffles and giveaways at the booth will generate exposure and will be used to contact potential clients.

• Join local financial organizations to host and attend business mixers to increase name recognition and increase contacts with bank customers

• Have social media strategy to strengthen existing client relationships and to attract new clients with incentives

• Have a series at local operating community events to discuss important software related issues such as internet security and social engineering dangers.

• To increase the customer base quickly, services will be below market price for the first year. To retain these customers, discounts will be offered for clients that use our services above certain levels.

• Referral incentives will be offered to current clients when they refer Discovery analytics Inc. offer potential clients.

• Become involved with community outreach which creates name recognition.

Strategy Plan

Competition

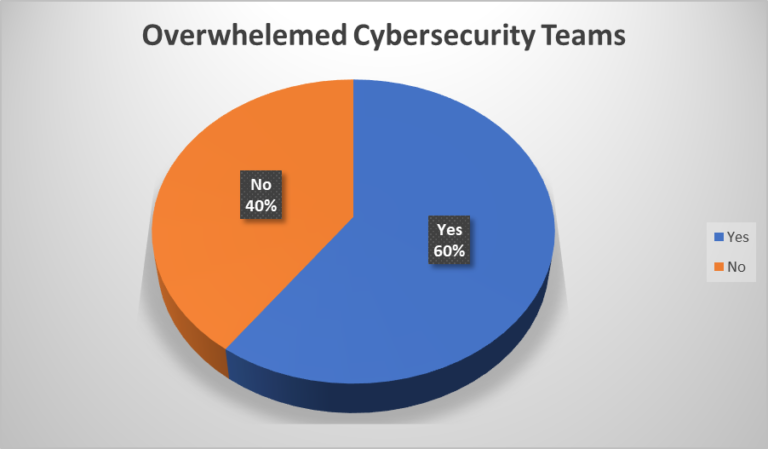

The major competition will come from other local computer support companies as well as one major franchise- squad. The local computer support companies are E3 end to end encryption and response computer group.

Competitor’s Strength:

- The franchises have name recognition and large corporations behind them for financial support.

- Locally owned companies have a well-established customer base and most have a good reputation with customer service.

Competitor’s Weakness:

- The franchise is very impersonal and expensive. Their employees are not focused on customer satisfaction

- The local companies are also expensive, and have difficulties retaining good employees

- The services they provide are very limited. They do not offer a full range of services for their customers

- The cost of operations is high for the local companies.

Competitive Analysis:

Barriers to Entry

Barriers of entry into the introduction of the advanced payment system using the hand held machines is purchase of the software and hardware. Other factors would be starting with a minimal customer base which needs require more capital for an advertising campaign.

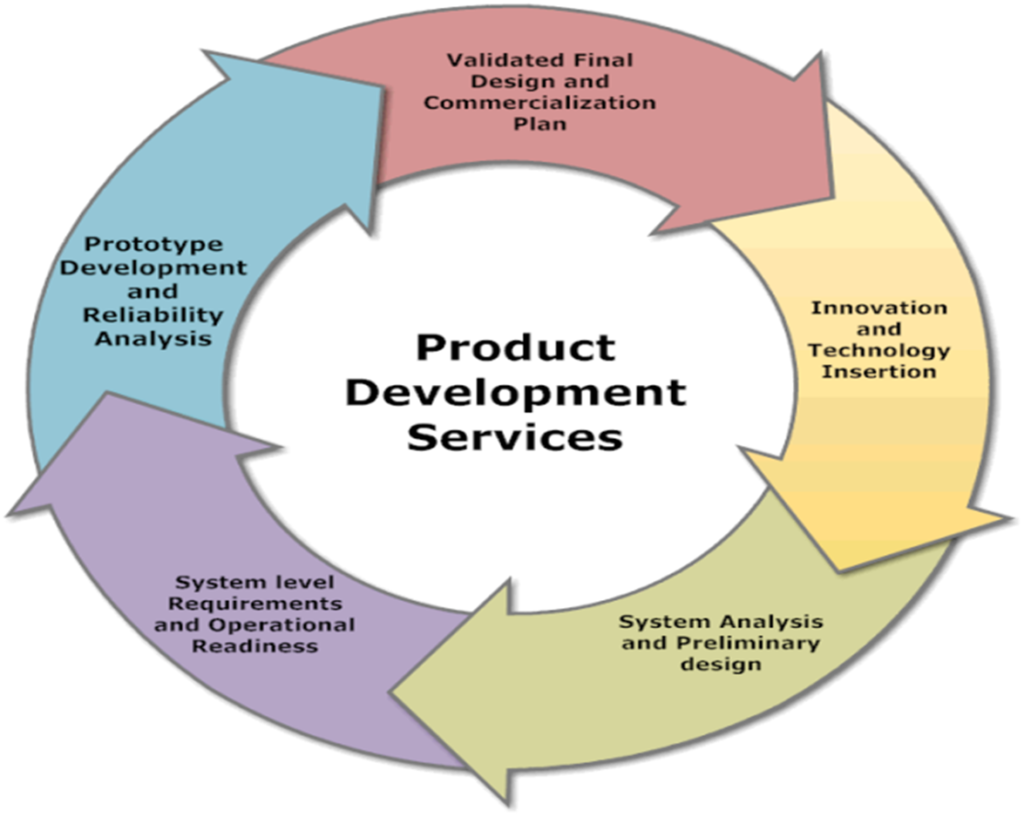

Project Plan

Market Definition:

The hand held support services is well established market, and demand for support services is constantly growing with the emergence of new technologies.

- Mobile banking services is in high demand, and local companies who cannot afford to hire full time computer support staff have a need to fill. As more data is being stored in cloud based storage, businesses are relying more on their networks to be reliable and need immediate servicing when problems arise.

- While the trend with residential customers is moving away from desktop computers, internet connectivity demand is rising. More and more devices need to connect to a secure wireless network at home, and residential customers need constant support with these devices and their home networks.

- Banking will always need a presence on the web. As e-commerce and social media grows, Banking need to keep up with this demand. They need web sites and social media support to connect with their customers in today’s connected world.

Value Proposition:

Customers:

The target market is small business and residential customers that need computer support. These customers will have specific needs in regards to their level of support. Residential customers will require desktop and home network support. Customers will need website design, software customization, network and workstation support.

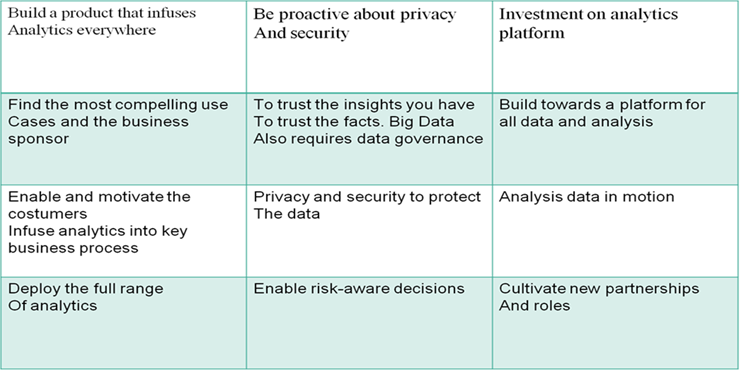

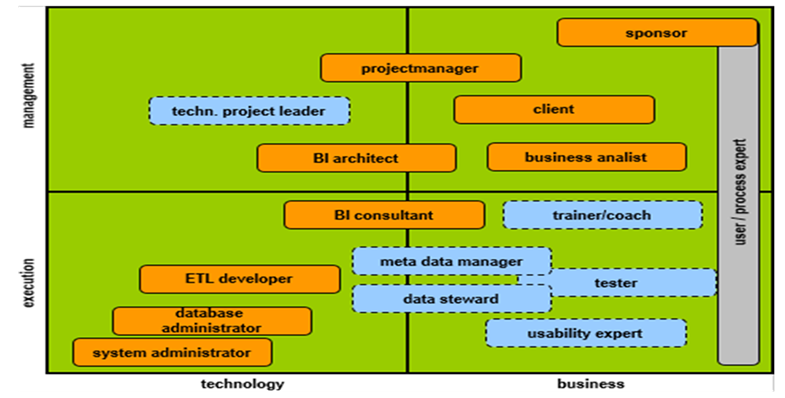

Banking Approach and Strategic Plan:

The vision of Discovery analytics Inc. banking is to align the strategic goals with those of the company’s. This includes updates to our architecture which will allow the bank to offer new and innovative services to our customers. It also includes new initiatives to broaden the customer base to engage a new demographic by expanding our social media and other mobile strategies using mobile dependent devices.

Mission:

The mission of Discovery analytics Inc. banking organization is to expand the growth of the company through innovative and creative initiatives by using technology to create new revenue streams and to offer service and support to our customers that far exceeds our competition.

Strategies:

To fulfill our mission and vision, we initiate the following strategies:

- Expand the current banking service to offer improved and new services to our customers.

- Expand the retail banking customers.

- Create a social media strategy to attract customers to our technical innovative services

- Expand software development into mobile application.

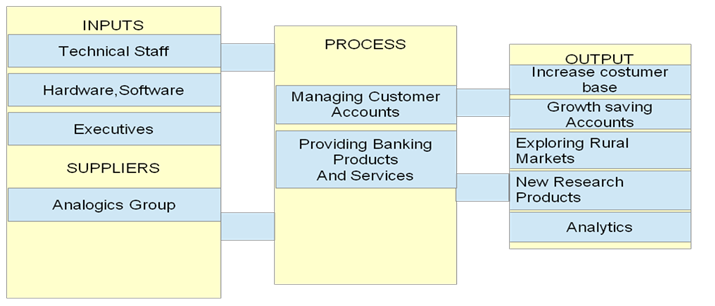

Input Process Output:

| Initiative Taken | Mobile Development |

| Description | Mobile computing has surpassed desktop computing, and Discovery analytics Inc. banking unit must keep up with this new trend. Our hand held machine operators will be trained to build mobile customized software that our customers are demanding. |

| Scope | Staff development for customizing and other applications in the hand held machines. |

| Rationale | Our B2B customers are demanding that their websites be compatible with all mobile devices. They are also looking for mobile applications to offer to their customers, and we need to meet these demands. |

| Risk | Low |

| Priority | High |

Service Expansion:

| Initiative Name | Data Center |

| Description | A Tier data center will be constructed that will allow Discovery analytics Inc. to offer mobile banking services, computing and cloud storage with customers details. The data center will also store the company’s internal databases for both the bank support and tech centers division. The mobile banking services will also be upgraded to allow the higher bandwidth traffic that will be associated with the cloud services. |

| Scope | To construct a new data base of customers to improve the strength of the mobile services. |

| Rationale | To expand services offered to our customers and create new revenue sources |

| Risk | Medium Without this initiative, We would lose out new revenue streams and possibly lose customers due to competition offered to such services |

| Priority | High |

| Sponsor | Discovery analytics Inc. |

| Team | IT division |