Engineering Economics 101

Engineering economics might sound boring, but trust me, understanding the costs of success is crucial for any engineer or entrepreneur. Essentially, engineering economics is about creating, estimating, and assessing economic results when there are different options to achieve a specific goal.

Some universities require engineering economics as part of undergraduate programs. This subject also appears on the Fundamentals of Engineering (FE) exam, and questions about it may also be included in the Principles and Practice of Engineering (PE) exam, both of which are components of the Professional Engineering registration procedure. In this article, we’ll cover some of the basics of engineering economics that you can use to make informed investment decisions.

Why should engineers study economics?

Engineers don’t work in isolation. They need to identify crucial factors like cost, demand, and other parameters. Sometimes, an economist is consulted to determine these factors. It’s wise for engineers to have a good understanding of these concepts.

What is the difference between economics and engineering economics?

How does economics differ from engineering economy? Economics is the study of the factors influencing the production, distribution, and consumption of goods and services. Engineering economy, on the other hand, is a branch of economics focused on its application to engineering projects.

What are the four fundamental principles of engineering economics?

1: A dollar received today is more valuable than a dollar received in the future.

2: The key factor is the difference between alternatives.

3: Marginal revenue should surpass the marginal cost.

4: Increased risk is acceptable only if accompanied by an anticipated increase in return.

Which cash flow is the most important and why?

In engineering economics, cash flow is the net amount of cash or cash equivalents being transferred into and out of business, especially affecting liquidity. There are different types of cash flows, such as initial, operating, and salvage. But the most important one is net cash flow, which is the total amount of cash that a project generates after all expenses have been paid.

Why is net cash flow so important?

Well, it’s because this is what determines the profitability of a project. If a project has a positive net cash flow, it means that it generates more cash than it costs to operate.

- Cash inflow examples: revenues, incomes, and savings generated by project and business activity.

- Cash outflows examples: machining cost, disbursements, expenses, and taxes caused by projects and business activity.

Once all cash inflows and outflows are estimated (or determined for a completed project), the net cash flow for each period is calculated using the following equation:

where NCF is net cash flow, R is receipts, and D is disbursements.

What is the significance of a cash flow diagram in engineering economics?

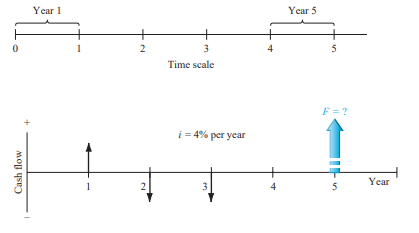

A cash flow diagram is a visual representation of the cash flows associated with a project over time. It’s like a graph that plots all cash inflows and all cash outflows, all cashflow is assumed to take place at the end of the interest period in which they occur. When several inflows and outflows occur within the same period, the net cash flow is assumed to occur at the end of the period.

Cash flow diagrams are important in engineering economics because they help us understand the timing and magnitude of cash flows. This is important because cash flows that occur earlier are generally more valuable than cash flows that occur later. Why? Because money today is worth more than money tomorrow. This is because we can invest money today and earn interest on it. So, when you’re analyzing an investment opportunity, create an accurate cash flow diagram. Below is an example of a cash flow diagram, the arrows pointing up are positive cash flow, while the arrows pointing down are negative cash flow.

Why is interest important in engineering economics?

Interest is the cost of borrowing money or the return on investing money. It’s expressed as a percentage, and it’s usually compounded over time. There are two types of interest: simple and compound. Simple interest is calculated as a percentage of the principal amount, while compound interest is calculated as a percentage of the principal amount plus any accumulated interest.

Interest is important in engineering economics because it affects the present and future values of cash flows. For example, if you have a cash flow that occurs in the future, you need to discount it back to the present to understand its value today. This is because money today is worth more than money tomorrow, due to interest.

When you’re analyzing an investment opportunity, make sure to pay attention to the interest rates involved. This will help you understand how much money you can make or lose over time. Interest paid on borrowed funds (a loan) is determined using the original amount, also called

the principal,

Interest = amount owed now – principal

When interest paid over a specific time unit is expressed as a percentage of the principal, the result is called the interest rate.

What is meant by rate of return?

let’s talk about the rate of return. This measures how much money you can expect to earn on investment over time. There are two common methods for calculating the rate of return: net present value (NPV) and internal rate of return (IRR).

NPV is the difference between the present value of cash inflows and the present value of cash outflows. IRR is the interest rate at which the NPV of cash inflows equals the NPV of cash outflows.

Interest earned over a specific period is expressed as a percentage of the original amount

and is called the rate of return (ROR). The higher the rate of return, the more profitable the investment is.

Interest and Money: Time Relationships

Interest and the relationship between money and time become relevant when the funding needed for a project must be obtained through borrowing or using existing reserves. Borrowing raises questions about interest and the value generated by completing the project. Meanwhile, using reserves means those funds cannot be used for other potentially more lucrative projects. Interest is essentially calculated as the product of the principal amount, time units, and the interest rate. However, interest calculations become more complex when factors like compound interest or annuities are involved.

Conclusion

In conclusion, Engineering Economics serves as a vital framework for engineers, enabling them to make informed decisions by considering economic factors alongside technical aspects. By understanding concepts like the time value of money, cost-benefit analysis, and risk management, engineers can optimize project outcomes, leading to more sustainable and successful solutions. Engineering Economics isn’t just about numbers; it’s about creating value, balancing trade-offs, and ultimately, engineering a better future for us all.