Automotive Conceptual Design, Program Timing and Financial Plans

Vehicle Design and Packaging

We are working on redesigning the current generation Toyota Sequoia. The Toyota Sequoia is classified as a sport utility vehicle (SUV). An SUV is a combination of a passenger car with the features of an off-road vehicle. In the US, SUVs are categorized as “light trucks”, as a result, regulations on these large vehicles are a lot more lenient compared to passenger cars. Based on competitive benchmarking, our team was able to develop the overall size and proportions of our MY26 Sequoia to not only be competitive but also outshine our competitors and set ourselves apart.

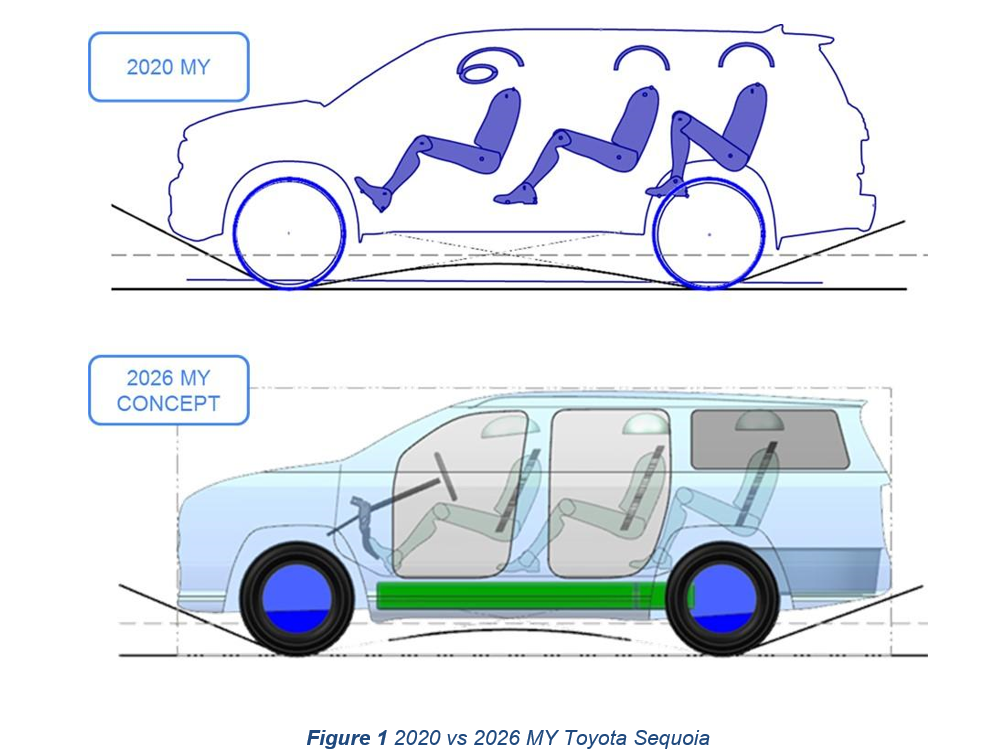

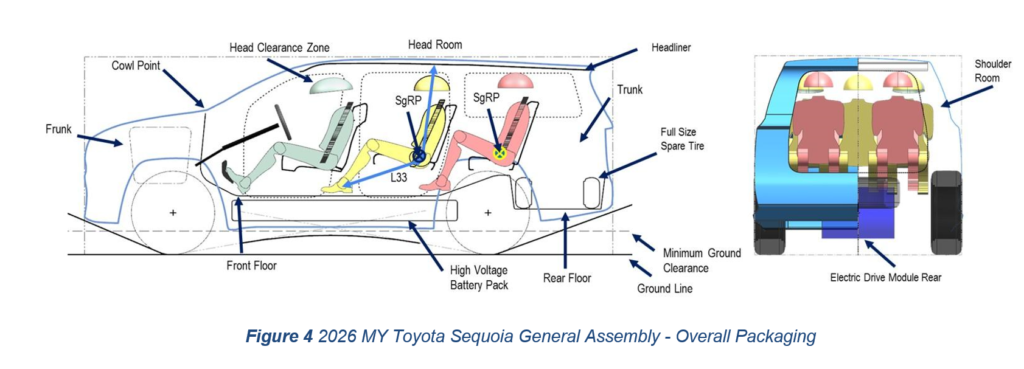

Figure 1 and Figure 2 are general assembly schematic representations that show the overall size of the vehicles and the occupant positions. Very quickly you are able to see major improvements in the design based on customer ratings and design requirements. Some of the key enablers of the design are:

- 3 Row Passenger room improvement.

- Aerodynamic performance.

- Dynamic spoiler.

- 105 kWh Battery Pack.

- Full-size spare tire.

- Improve cargo volume with the introduction of front storage (Frunk).

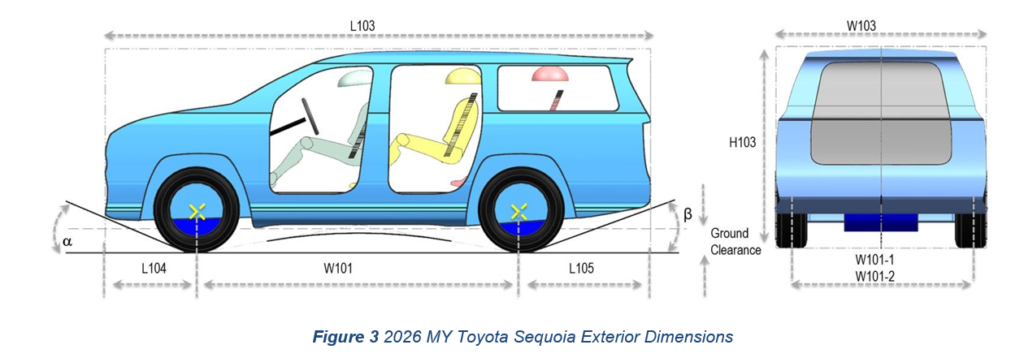

Overall Exterior Dimensions

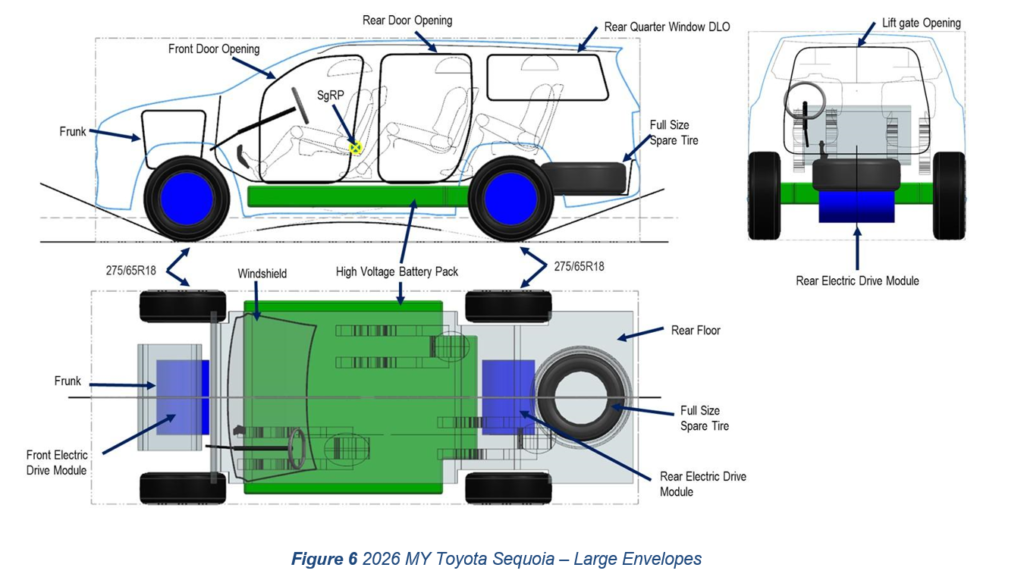

For the MY2026 Toyota Sequoia, we were able to maintain a similar exterior vehicle layout to the current generation, improving the interior cargo volume and occupant packaging. Figure 3 shows the vehicle envelope with locations of wheels, front and rear overhangs as well as main exterior dimensions such as overall height (H103), width (W103), and length (L103). Approach angle (A106-1), departure angle (A106-2), and ground clearance (H156). The overall vehicle layout was redefined to provide maximum protection to the High Voltage Battery Pack located at the bottom of the vehicle. Figure 6.

| Dimension (in.) | 2020 Toyota Sequoia | 2026 Toyota Sequoia BEV |

| L103 | 205.1 | 209 |

| H103 | 77 | 76 |

| W103 | 79.9 | 79 |

| W101 | 122.2 | 121 |

| L104 | 34.8 | 34 |

| L105 | 48.1 | 48 |

| W101-1 | 67.9 | 67 |

| W101-2 | 69.1 | 68 |

| A106-1 | 27 | 23 |

| A106-2 | 21 | 21 |

| H156 | 9.9 | 9 |

Vehicle Package

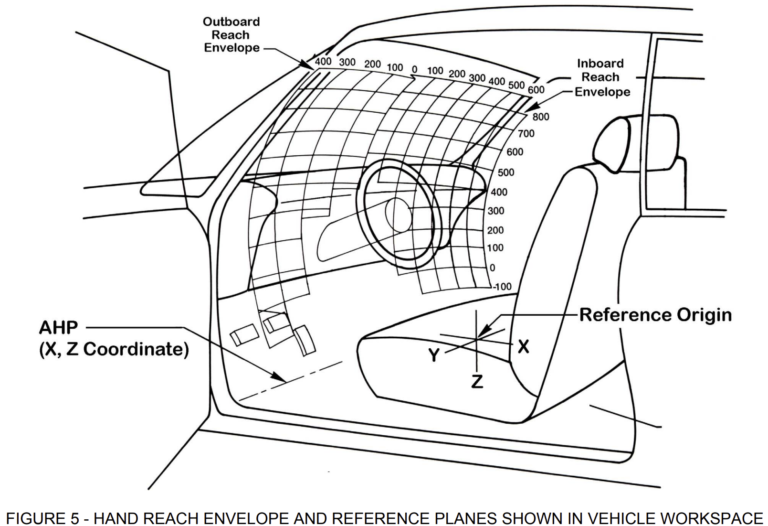

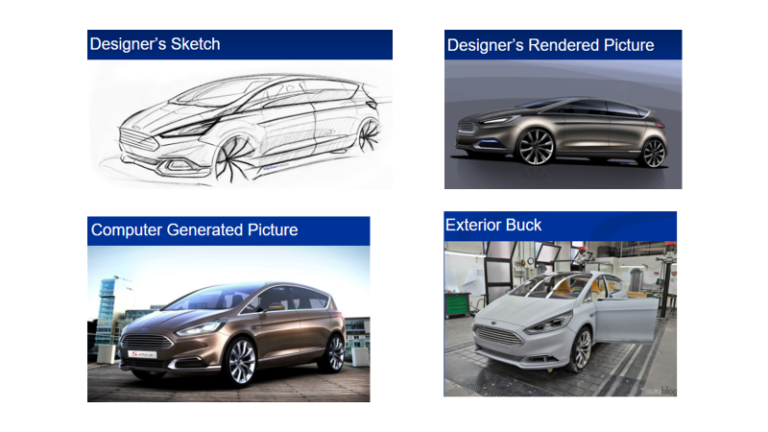

Our MY2026 Toyota Sequoia has a noticeable improvement in the 3rd Row Occupant leg and headroom without sacrificing any storage or cargo volume. With the removal of the front engine and the introduction of a High Voltage Battery above the floor, we were able to introduce an extra space for storage in the front truck of the vehicle also known as “Frank”. Table 2 lists the main occupant dimensions from our current vehicle and the future Toyota Sequoia. Figure 4 is a representation of the occupant compartment bases in the basic steps for design:

- Locate the vehicle floor.

- Locate firewall / Cowl point.

- Determine seating reference point for each passenger (SgRP)

- Locate the steering wheel.

- Locate available headroom.

- Locate Storage and cargo volume areas.

- Locate the position of the power train: High Voltage Battery.

- Locate spare tires if any.

- Locate the ground line and minimum ground clearance.

- Locate ankle position

- Locate the gas pedal.

- Drivers hand reach reference plane (SAE J287)

| Dimension (in.) | 2020 Toyota Sequoia | 2026 Toyota Sequoia BEV |

| 1st Row Headroom | 34.8 | 42.5 |

| 2nd Row Headroom | 34.9 | 40 |

| 3rd Row Headroom | 34.5 | 40 |

| 1st Row L33 | 42.5 | 43 |

| 2nd Row L33 | 40.9 | 42 |

| 3rd Row L33 | 35.3 | 38 |

| Cargo Room | 120.1 | 135 |

Vehicle Envelopes

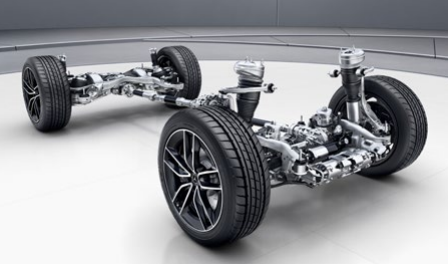

Figure 6 shows the designed opening of the front door, rear door, and lift gate opening (B&R lines) as well as the required rear quarter window. The steering wheel can be seen inside and in top view and how it aligns relative to the front wheels and windshield. The Top view of the vehicle also gives a visual of the position of the spare tire, front and rear electric drive module, and size of the high-voltage battery.

The components shown in Figure 6 represent some of the hard points of the vehicle and their dynamic and static envelopes need to be considered while designing the components around them.

Market Trend by 2026

According to a New Research study, the worldwide SUV market size is projected to reach USD 2899.5 million by 2026, from USD 2822.9 million in 2020, at a CAGR of 2.5%. Out of all the cars sold in 2019, 3.7% of the worldwide share was captured by pickup trucks. Based on this study it is seen that the customer base is moving towards the large SUV segment as the drivers enjoy the feel of the higher and more comfortable driving position of sporty new SUVs. This mindset and ever-increasing market demand is the tipping point that we as automakers are intending to capture. As the industry and consumers profess to be excited about electric vehicles, a growing number of drivers are switching passenger cars for beefier, fuel-guzzling SUVs. Automakers are bringing in a greater variety of crossovers, trucks, and SUVs to market. They are eager to capitalize on rising demand with vehicles that are very profitable to sell. Focusing on this trend in the market, our concept vehicle incorporates the performance benefits of Conventional Vehicles and Hybrids by introducing Best In class Battery Powered Full Electric Large sized SUV, while still keeping all the practical aspects of a full-size SUV.

As per our preliminary design stage and the benchmarking process we tried to understand the market segment. From this research, we were able to determine who the target audience will be, and how much these customers are willing to pay for a full-size SUV to determine the starting price, and what do they expect in a new SUV. We also gauged how enthusiastic our customers were to have an all-electric full-size SUV and how comfortable they were with making the change from a conventional ICE vehicle to a BEV. Our target customers are listed below based on the survey from the Preliminary Design Specifications project:

Target customers:

- Customers’ age range – The Middle Age(30-50)

- Unmarried customers for the daily work commutes, long drives, and for adventure trips.

- Married customers with family who enjoy adventure and wouldn’t be caught dead in a minivan, long drive but will also use this as a daily driver.

- For basic camping trips, for holding luggage like bicycles, and for carrying heavy equipment.

- Customers with the requirement to drive through varied terrains. Who enjoy occasional Off Roading capabilities.

The Toyota Sequoia fits into the current trend of SUVs and hence its customers are expected to use it mainly as a family vehicle. The target customer would be parents (both male and female) aged between 30 – 50 years old. Since the average American family size in 2019 is 2.6 people per household, the customer will most likely be accompanied by more passengers most of the time. Customers would hence require to carry people and also sufficient luggage with minimal compromise. The vehicle will also be targeted toward adventurous individuals. These individuals usually enjoy occasional off-roading. The Toyota Sequoia will have a better range than all EVs currently on the market and 0 to 60 acceleration in 3 seconds. All of this performance will be provided without any compromise on the torque, leg room space, and be capable of light off-roading. This provides the vehicle with sufficient yet subtle flexibility. The inclusion of the electric drive instead of the conventional ICE increases off-road traction as it has higher low-end torque aiding off-road traction and wheel speed. Going all Electric BEV Large SUV is the most exciting part as it is the first in class as of the program start date but also comes with its own share of uncertainty during the release as there is a major trade-off with the battery sizing and towing capacity of the vehicle.

Sales Projection

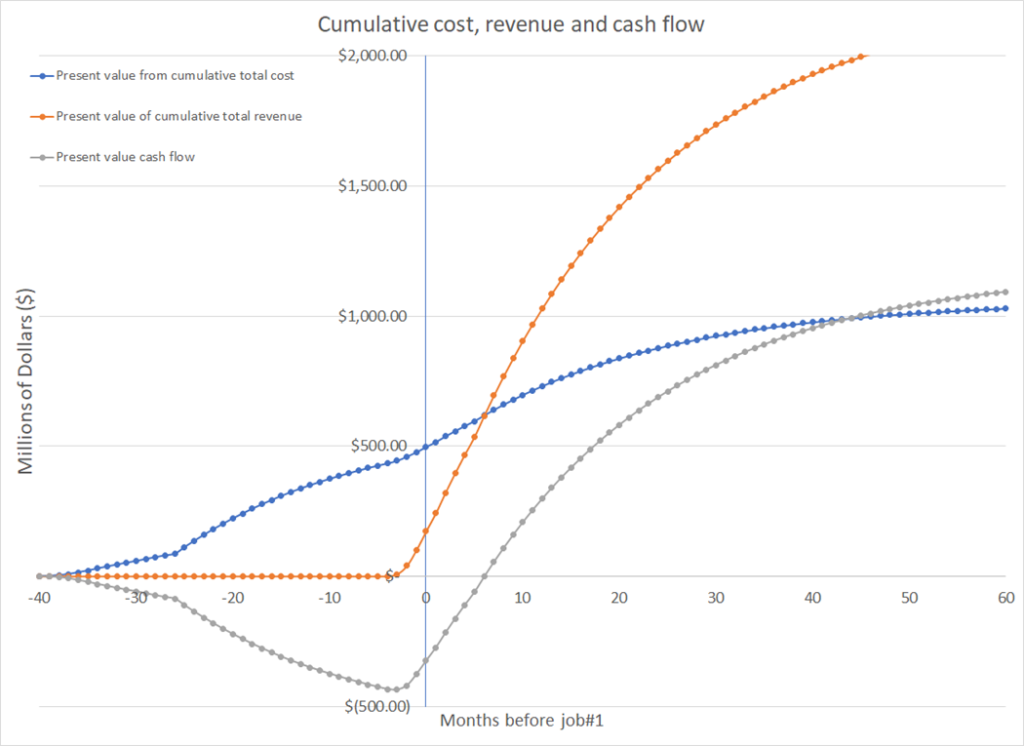

The sales for SUVs and pickup trucks have been rising at the expense of sedans and the trend is expected to continue as OEMs shift their focus towards developing more SUVs and trucks to meet consumer demand. With the proposed design and the cost analysis, the entire timeline for the actual vehicle production starts 40 months earlier and the program is spread across a 100 months time plan from cradle to grave. The entire cost estimated in the pre-production phase is $20,200,316.48 considering the inflation and the estimated number of vehicles that will be sold, 5 years after the first Sequoia runs off the assembly line we will have earned a profit of 906,200. Each vehicle we sell will have an estimated profit of about $9,725.The program is set up in a way that we reach a very early break-even point based on the demand this EV Sequoia MY2026 will create in the market. A 7-month timeline is forecasted for break even.

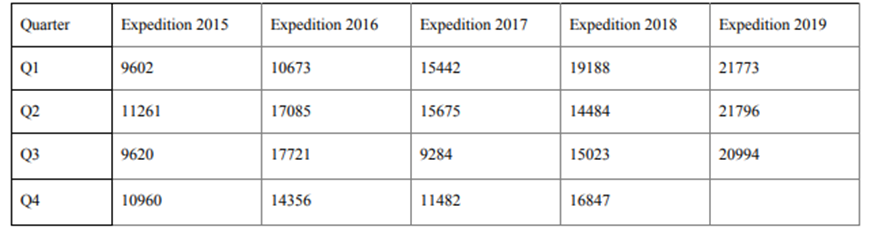

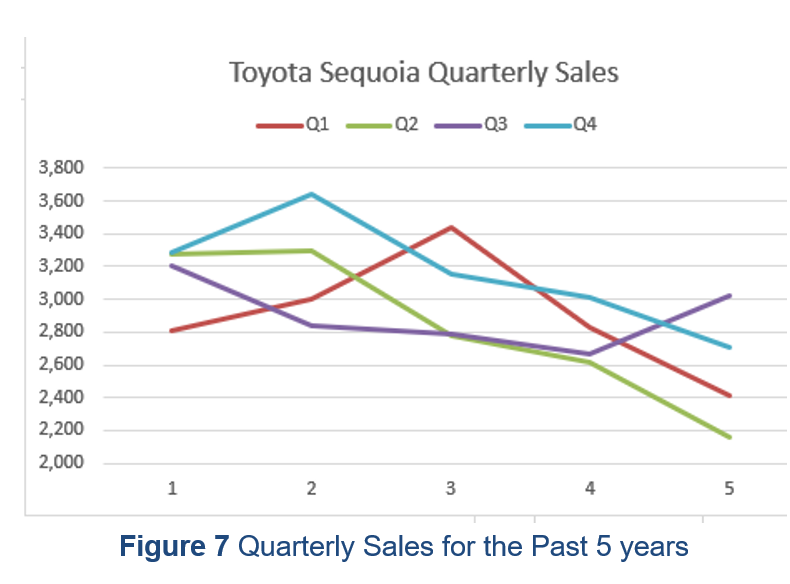

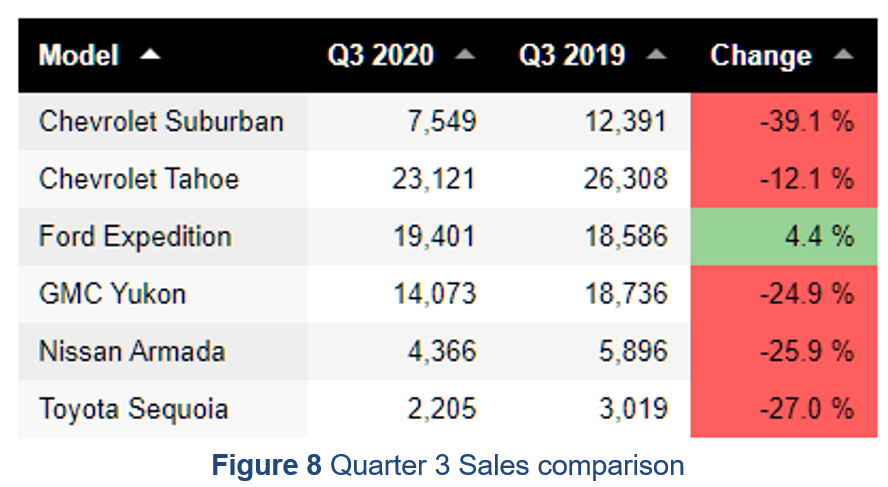

The sales data is based on the growth of the SUV segment sales in the last 6 years from 2016-2020, specifically the Toyota Sequoia in the US market. The total sales made per quarter in the last 6 years was around 3500. We can see the declining trend in the sales of this SUV, the best sale numbers being in 2005 when 45,000 numbers were sold in a year, to worst towards the start of the pandemic. In March 2020 Toyota sold as little as only 200 Sequoias. The sales projection values consider the inflation rate, auto-sector growth, and manpower costs. This new MY26 Sequoia will bring a much-needed refresh to the current generation, as this is considered to be the first BEV in the full-sized SUV segment and priced at a very competitive price of 51,000. We estimate a monthly sale to be 15,000 numbers when the model gains popularity and is at its peak sales. This number is considering the global market and does not focus on the USA alone. However, if we see the detailed report on the timeline and cost this number is reached gradually. These numbers were determined after checking the sales of the Ford Expedition (the reference vehicle) which had quarterly sales of about 12,000 to 15,000 only in the US market.

| Quarter | 2015 CY | 2016 CY | 2017 CY | 2018 CY | 2019 CY | 2020 CY |

| Q1 | 2,811 | 3005 | 3437 | 2,828 | 2,410 | 1,408 |

| Q2 | 3281 | 3292 | 2774 | 2613 | 2154 | 1120 |

| Q3 | 3207 | 2837 | 2788 | 2664 | 3019 | 2205 |

| Q4 | 3284 | 3637 | 3157 | 3016 | 2706 | — |

To keep our demand high and have the best response from customers ensuring a steady cash inflow we plan to release mid-cycle upgrades and special editions at the 1/2 mark of the program i.e 4 years down the line. This Mid-cycle refresh will incorporate additional features such as SLA suspension with height control, driver assist features such as a Toyota proprietary level 3 – 4 autonomous driving capability, an exterior front facelift, a special edition on interiors, and a sports performance package.

Selling Price:

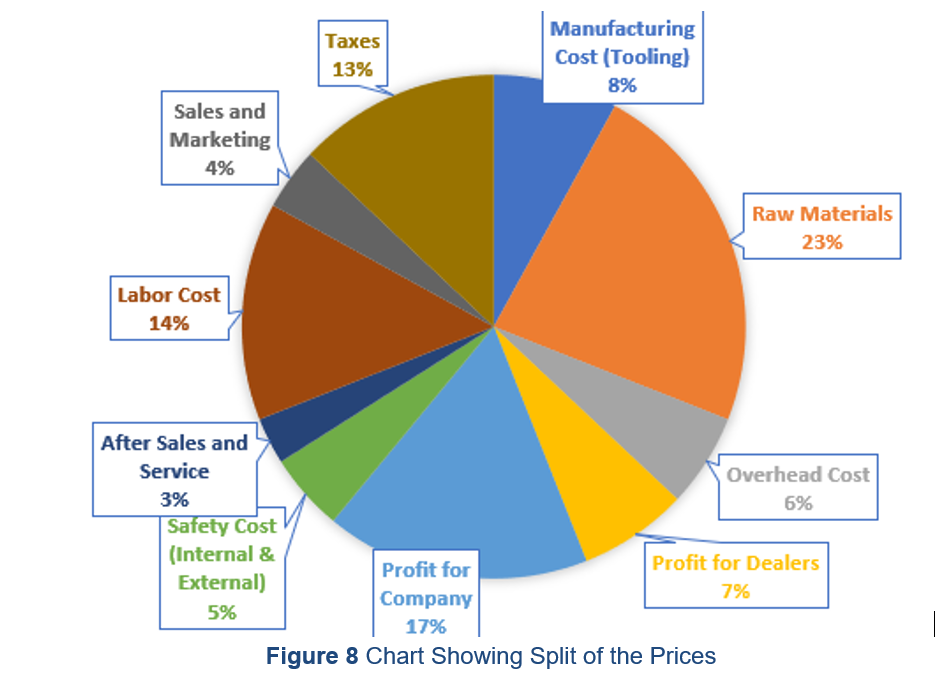

There are two ways to determine the MSRP of the product. The first is the traditional approach which is the cost price plus approach and the second, the modern method is the sales price minus method. The MSRP has been determined for this product using the sales price minus method.

From the earlier benchmarking, the price of the Ford Expedition 2020 (Reference Vehicle) was $52,130, Chevrolet Tahoe (Competitor Vehicle 1) was $48,000 and Nissan Armada (Competitor Vehicle 2) was $47,100. After the market surveys and research, the inflation rate per annum is calculated to be 2% and the interest rate is calculated to be about 8% after all calculations, the MSRP of the Toyota Sequoia EV MY2026is set to $51,000. The Financial Analysis is based on three factors that are kept in mind while projecting the sales figures:

a) EPA and NHTSA regulations regarding the new emissions to be proposed during the year 2023.

b) Inflation rate, keeping in mind the current market trends, and the growth of the automotive sector in the US.

c) Current SUV market segment trend in which the estimated growth is predicted to be around 25% with an increase of 5.64% from 2023.

The selling Price split up

| Description | Percentage, % | Cost, $ |

| Manufacturing Cost (Tooling) | 8 | $ 4,080.00 |

| Raw Materials | 23 | $ 11,730.00 |

| Overhead Cost | 6 | $ 3,060.00 |

| Profit for Dealers | 7 | $ 3,570.00 |

| Profit for Company | 17 | $ 8,670.00 |

| Safety Cost (Internal & External) | 5 | $ 2,550.00 |

| After Sales and Service | 3 | $ 1,530.00 |

| Labor Cost | 14 | $ 7,140.00 |

| Sales and Marketing | 4 | $ 2,040.00 |

| Taxes | 13 | $ 6,630.00 |

| Total Cost | 100 | $ 51,000.00 |

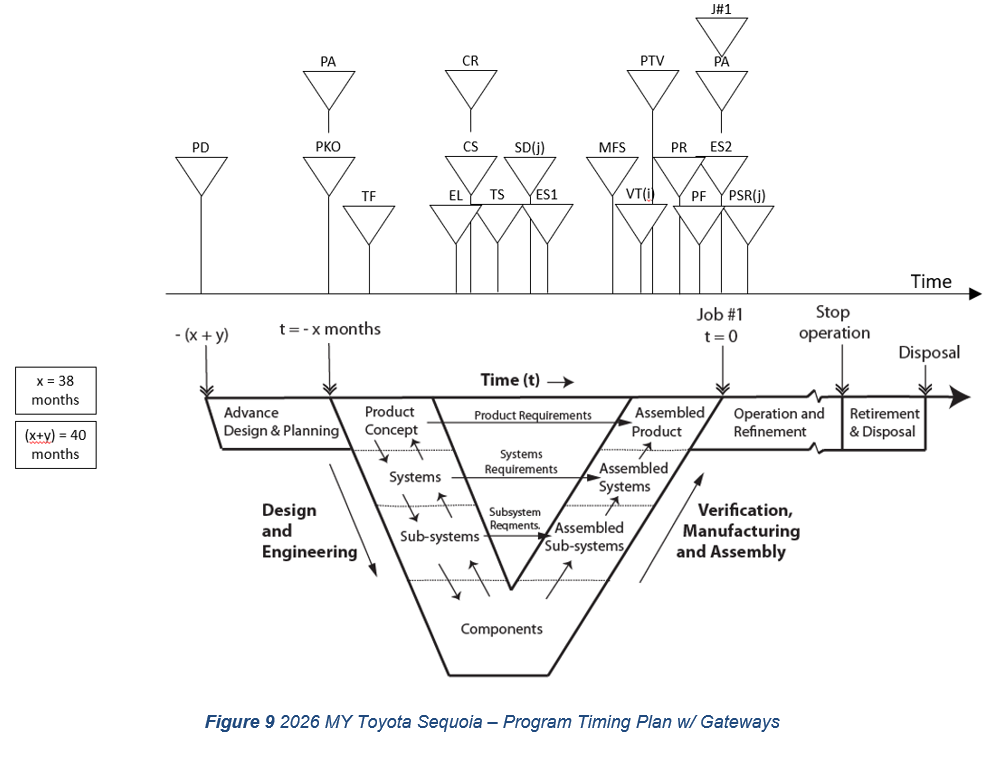

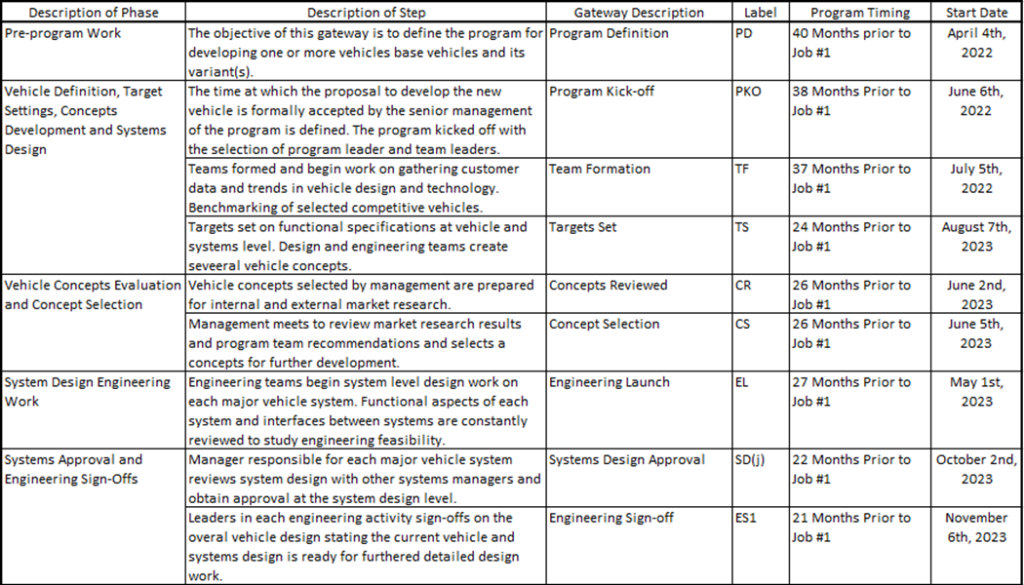

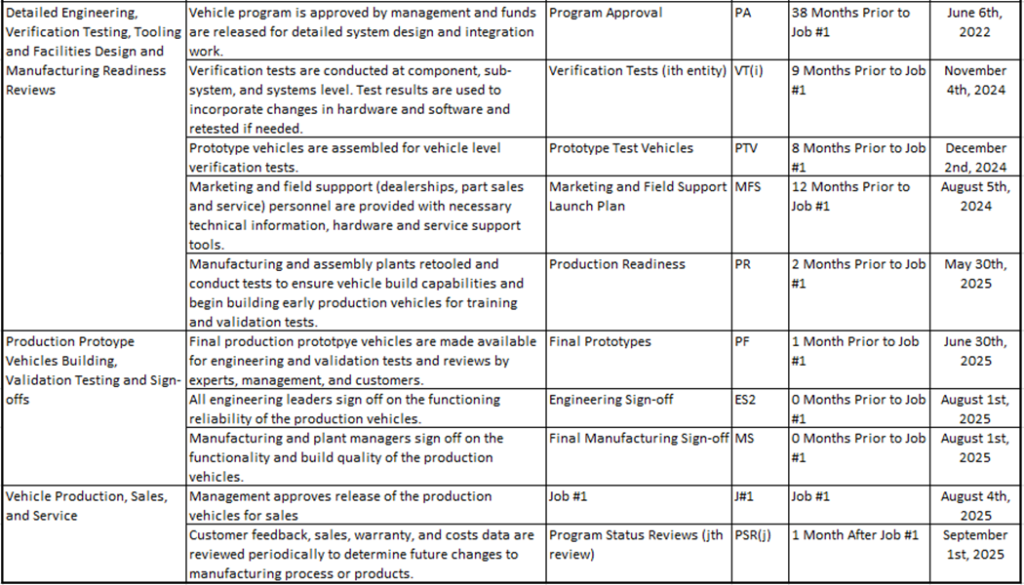

Program Timing

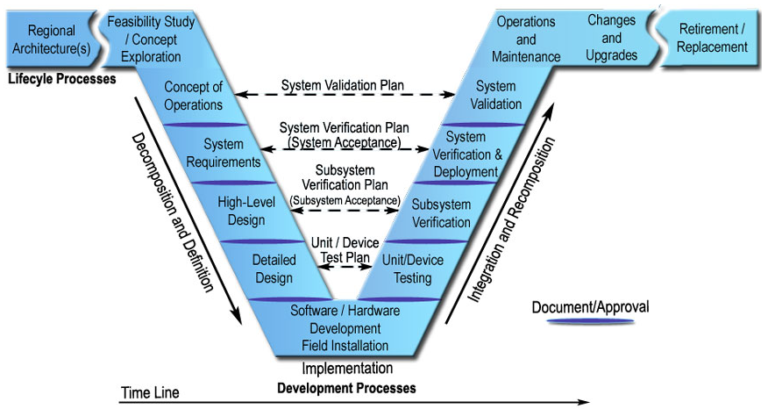

Our program timing plan was developed for the purpose of having the vehicle prepared for the 2026 model year. As such, we planned key deadlines and timings in order to be prepared for this. In order to meet the 2026 model year, we set our Job # 1 date for the first Monday in August 2025, August 4th. We accordingly planned all other key gateways around this. Figure 9 below details the program timeline for our key gateways in relation to the Systems Engineering “V” model discussed in the textbook (Bhise, p. 352). Below that, Table 6 discusses program timing in detail, including an explanation of the gateways, program timing in relation to Job #1, and target dates for goals to be completed.

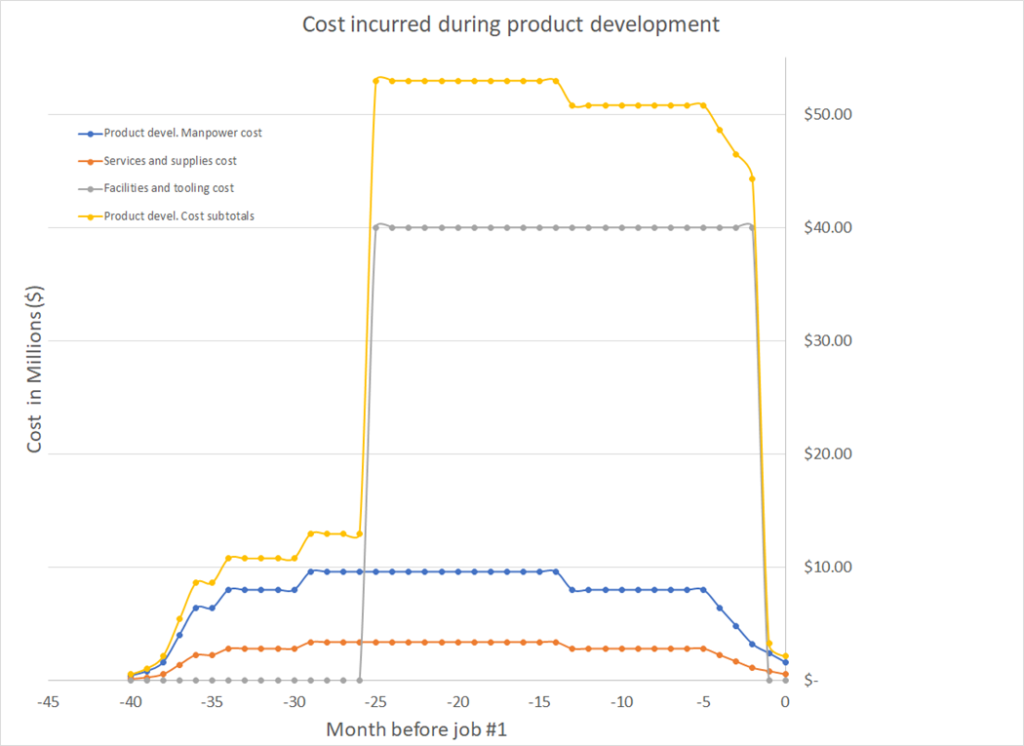

Program Development Cost

While projecting the business plan, the employees were paid ( White collar) $45 per hour and blue-collar for a 25-day work period, split into 2 shifts ~ 28 per hour. The manpower costs, tooling costs, and service costs are around $x Million as estimated. The sales of the vehicle are estimated to be around 12,000 (approx.) per month once the vehicle is launched. Considering the growth trend, the sales are expected to grow x% in the first year, followed by x% in the following year and x% in the 3rd year of production.. This will mark the launch of a new future model in the same segment. With the projected cost analysis, the total cost incurred until production is around $x billion and the total revenue generated is around $x billion in present market value. In order to generate revenue, around x vehicles need to be sold in the first year.

Cost summary graph

Cumulative cost, revenue and cash flow graph

References

- Automotive Product Development: A Systems Engineering Implementation, by Vivek D. Bhise. ISBN: 978-1-4987-0681-0. Publisher: CRC Press, Boca Raton, FL: CRC Press, 2017. (APD)